The Bolsa de Valores de Colombia (BVC)is the primary securities exchange in Colombia. Despite Colombia being one of the larger economies in Latin America, its stock market remains relatively small. One of the possibilities to invest in the country as a foreign investor is investing in US-listed Colombian stocks.

Colombian stocks listed in the US are Bancolombia, Grupo Aval, Ecopetrol, Geopark, Tecnoglass, and Almacenes Exito. These companies trade on the New York Stock Exchange (NYSE) through American Depositary Receipts, or ADRs, which are negotiable certificates representing ownership of shares in a foreign company traded on US stock exchanges.

The restricted depth and liquidity within the Colombian stock market raise important factors for investors to consider. It is crucial to be mindful of potential risks, especially when investing in individual stocks within Colombia’s volatile market. This article will offer a concise overview of the top Colombian stocks worth considering.

Liquidity Considerations for Colombian Stock Investments

To start with, it is first important to be aware of the liquidity issues that the Colombian stock market is facing. JPMorgan Chase & Co. issued a warning in a report if liquidity keeps falling as the country faces a potential reclassification to frontier status by MSCI Inc.

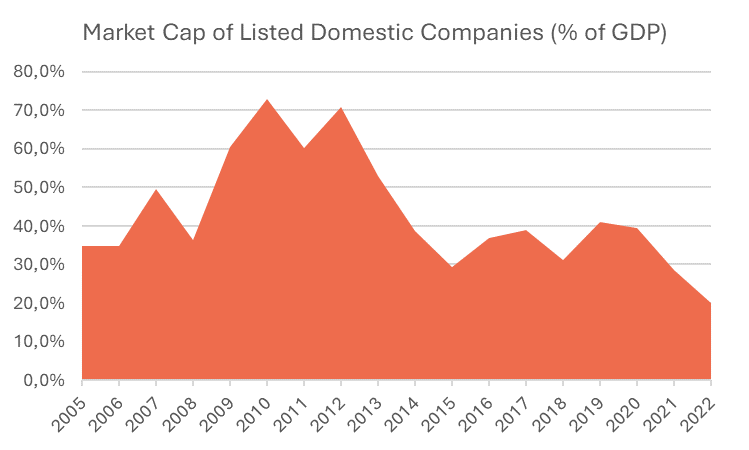

Colombia narrowly satisfies the criteria of the MSCI Emerging Market Index, with just three listed stocks, comprising a mere 0.1% of the index. These account for just 0.1% of the index. A downgrade could prompt global investors and exchange-traded funds to reduce their holdings in Colombian stocks. In the past 10 years capital has flowed out of the country as investors dump Colombian assets.

In recent years, the stock market’s capitalization-to-GDP ratio has persistently decreased, reflecting the comparatively modest size and depth of the Colombian stock market to the economy. Additionally, investor confidence in the country remains low.

Political risk has led to Colombian stocks being overlooked by investors even though they are trading at attractive values. Learn more about the implications of political risk on Colombia’s stock market by clicking HERE.

Colombian Stocks Listed in the US

Bancolombia

Ticker: CIB

Listing: NYSE

Market Cap: $8.30B

The long history of Bancolombia started in 1875, as it was founded in Medellín as the Bank of Colombia. Furthermore, it became the first Colombian company to trade on the New York Stock Exchange (NYSE) in 1995. The merger of Banco de Colombia and Banco Central Colombiano (BIC) led to the formation of the company known today, as Bancolombia.

Bancolombia is the largest commercial bank in Colombia, offering a wide range of financial products and services to individuals, businesses, and institutions. The bank provides banking accounts, loans, insurance, investment products, and asset management services. Its presence stretches beyond Colombia, reaching Panama, Guatemala, and El Salvador.

Grupo Aval

Ticker: AVAL

Listing: NYSE

Market Cap: $2.65B

Grupo Aval was founded in 1971 and has grown to become one of the largest financial conglomerates in Colombia. Founded by entrepreneur Luis Carlos Sarmiento Angulo, Grupo Aval has interests in banking, pension funds, insurance, and investment banking. It has controlling stakes in financial entities such as Banco de Bogotá, Banco de Occidente, Banco Av Villas, Corficolombiana, and the pension and severance fund administrator Porvenir.

Luis Carlos Sarmiento Angulo who led the company from the beginning to become the country’s most important banker announced his retirement meaning a shift of leadership. His son, Sarmiento Gutiérrez will become his successor and María Lorena Gutiérrez will become the CEO.

Ecopetrol

Ticker: EC

Listing: NYSE

Market Cap: $22.40B

The reversion of “The Mares Concession” to the Colombian State in 1951 led to the formation of the Empresa Colombiana de Petróleos, absorbing the assets of the Tropical Oil Company, which initiated oil operations in Colombia in 1921. It was fully owned and operated by the state for years. In 2003, the company was internationalized and became publicly listed on the NYSE under the new name, Ecopetrol.

Ecopetrol is the largest petroleum company in the country and among the largest in Latin America. It operates across all sectors of the oil and gas industry, from exploration and production to refining, transportation, and marketing of hydrocarbons and their derivatives. With the state maintaining an 88.49% ownership stake, Ecopetrol remains a substantial contributor to government revenues while providing employment opportunities.

Geopark

Ticker: GPRK

Listing: NYSE

Market Cap: $0.52B

Founded in 2002, GeoPark is a leading independent exploration and production (E&P) company in Latin America. In 2012, GeoPark expanded its operations to Colombia by acquiring the renowned Llanos 34 block. Since then, it has achieved an impressive drilling success rate of over 90%. In 2014, following a successful Initial Public Offering (IPO), GeoPark shares were listed on the New York Stock Exchange.

The company engages in the exploration, development, and production of oil and gas assets. The goal is to increase reserves and production through organic growth and strategic acquisitions. Geopark has a proven history of discovering and developing oil and gas reserves. Thereby it utilizes advanced technologies and innovative approaches to optimize production and maximize value.

Tecnoglass

Ticker: TGLS

Listing: NYSE

Market Cap: $2.48B

Tecnoglass is a leading manufacturer of top-quality glass and aluminum products for the global commercial and residential construction industries. Founded in 1984, the company has been supplying high-quality glass products to the local market in Colombia. Over time, they expanded their operations to cater to customers in international markets, such as the US. In 2012, Tecnoglass went public by listing its shares on NASDAQ (since 2022 the stock is listed on the NYSE).

The company is located in Barranquilla, Colombia, and operates a manufacturing complex of over 4.1 million square feet. They cater to over 1000 customers worldwide, with over 90% of their revenue coming from the United States market. Their product range includes a variety of glass solutions, such as tempered glass, laminated glass, insulated glass units, and low-emissivity glass. They also offer aluminum frames and accessories.

Almacenes Exito

Ticker: EXTO

Listing: NYSE

Market Cap: $0.82B

The Colombian supermarket chain, Almacenes Exito, was established in 1949 in Medellín. It has since become a prominent leader in the retail industry, operating a wide range of hypermarkets, supermarkets, and convenience stores throughout Colombia, Brazil, Uruguay, and Argentina. In 2023, Almacenes Exito had its initial public offering (IPO) on the NSYE.

The company offers products, such as groceries, household items, electronics, clothing, and more. Almacenes Éxito is known for its strong brand reputation, extensive product selection, and commitment to providing quality goods at competitive prices. The company also has a significant presence in e-commerce, offering online shopping and delivery services to its customers.