Amid the downturn of the broader Brazilian equity market, two Brazilian stocks are thriving. The two outliers – aircraft manufacturer Embraer and fintech Nubank – are disruptors in their respective industries. Both challenge industry incumbents with new business models aiming to rock the status quo.

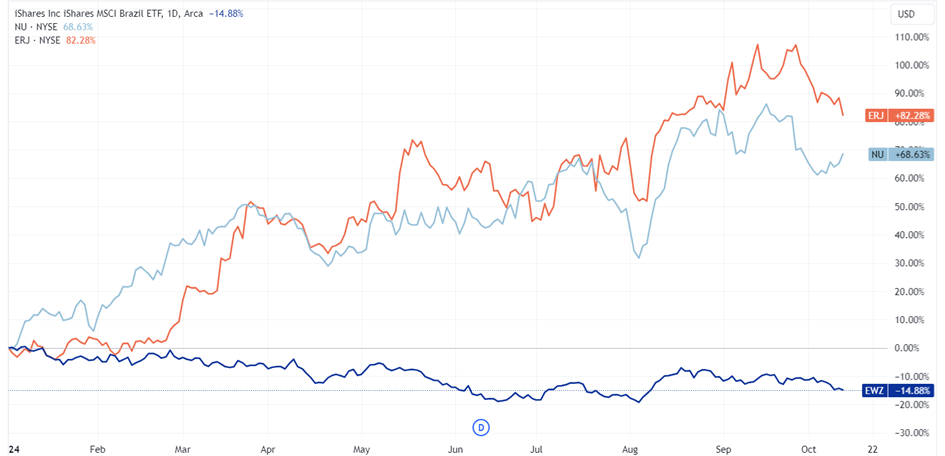

The two companies have shown impressive returns for their investors this year. Brazil’s country ETF (ticker: EWZ) has a YTD performance of almost -15 percent. Embraer (ticker: ERJ) shows a YTD performance of over +80 percent and Nubank (ticker: NU) of approximately +70 percent.

Brazil’s Market Among Worst Performers

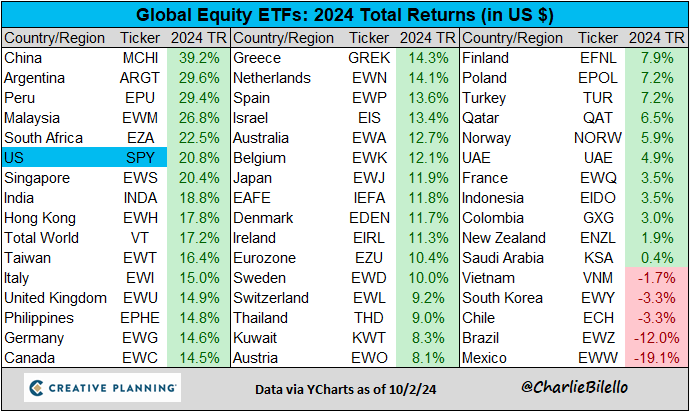

The market dip in Brazil’s equity markets has positioned it among the worst-performing countries in the world. Latin America’s second-biggest economy, Mexico, is the only country performing worse than Brazil over the first three quarters of 2024.

The main reason for this market slump is the fiscal deficit the country faces under the second presidency of Lula da Silva. Nothing sets the hairs on the back of investors’ neck stand up more than a socialist president running budget deficits in Latin America.

Making things worse for Lula is the huge contrast with neighboring country Argentina which under president Javeir Milei is cutting back the public sector and implementing free market policies. At time of writing, Argetina’s country ETF (ticker: ARGT) stands +42,81 percent and is the best-performing in the world.

Both factors led to soured market sentiment about Brazil which on valuation is hitting record lows. When comparing the market capitalization of Bovespa to Brazil’s money supply, it appears that Brazilian equities are trading at near-historical lows. Only in 2002 were prices lower than they are at present.

Why Embraer and Nubank Outshine Brazil’s Market

While the majority of Brazilian equities have experienced a downward trend, the share prices of Embraer and Nubank soar higher. Although they operate in entirely different industries, both companies share a disruptive approach and cater to niche markets. Let’s take a closer look:

Embraer

(ERJ): Brazilian Aircraft Manufacturer Niche Winner in Small Aircrafts

Embraer is a Brazilian aircraft manufacturer founded in 1969 by the Brazilian government. During the 1990s, the company was privatized and eventually became publicly traded on the New York Stock Exchange (NYSE) in 2000.

The company has divisions for commercial, executive, military, and agricultural aviation. Its main edge over competitors is its specialization in small- to mid-sized airplanes. These became particularly in high demand since the pandemic, which led to an increase in the demand for private jets and smaller-sized commercial aircraft.

Two giants dominate the aircraft manufacturing industry; this duopoly consists of Boeing and Airbus. By focusing on its niche market of smaller airplanes, Embraer has managed to secure orders abroad.

Embraer’s American Depositary Receipt (ADR), listed on the NYSE under the ticker ERJ, has achieved a year-to-date (YTD) performance of 86%. This accomplishment is particularly noteworthy when contrasted with the Brazilian country ETF, which stands at -15% YTD.

Nubank (NU): Revolutionizing Banking for Latin America’s Underserved

Nubank, also known as Nu, stands as one of Latin America’s most disruptive companies. The neobank was founded in 2013 by Colombian founder David Vélez who struggled to open a bank account after relocating to Brazil. Brazil’s banking sector was exclusively reserved to the elites of society leaving the rest of the people unserved.

Since then, the company has made it its mission to make financial services accessible to the unbanked population in Latin America. It started in Brazil where it quickly grew its customer base. Nu expanded to Colombia and Mexico seeking to have the same success.

Nubank has since emerged as a paradigm for fintech innovation globally. The neobank leverages advanced technology to fuel its expansion, focusing on providing financial services to the historically underbanked populations across Latin America.

The company’s business model and growth trajectory have garnered significant attention from both the financial services industry and investors, positioning Nubank as a potential disruptor in emerging markets’ financial landscapes. Nu’s ADR, listed on the Nasdaq since 2021 under the ticker NU, has achieved a year-to-date (YTD) performance of 59%.

Brazil’s Market Value: Cheap for Long or Ready to Mean Revert?

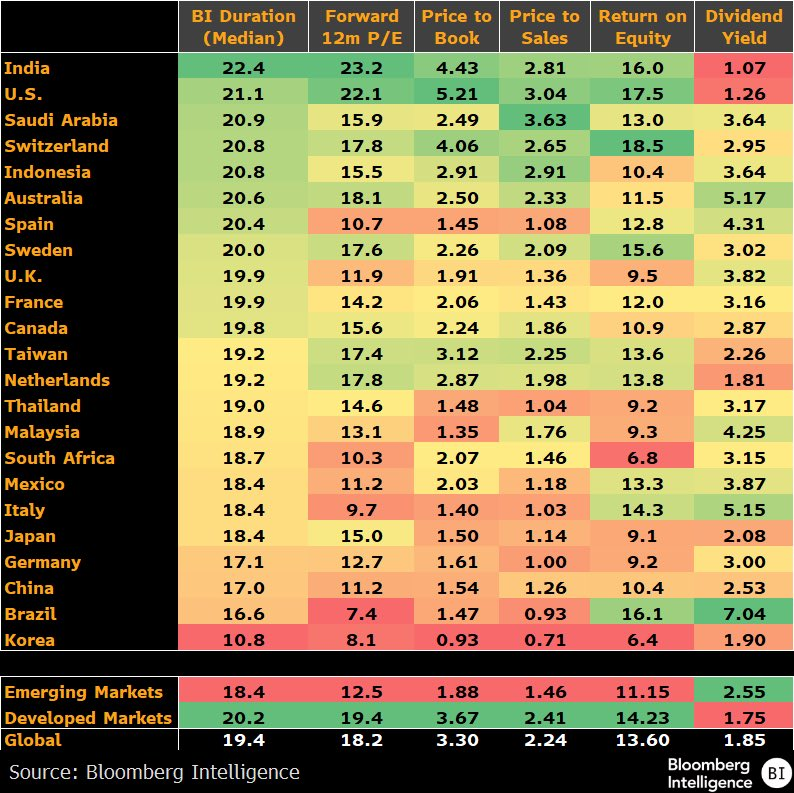

As shown below, Brazil’s price-to-earnings ratio is among the lowest in the world, and its dividend yield is one of the highest. This does not necessarily mean that its market will experience significant growth.

Flows do indicate that foreign investors injected 10 billion reais ($1.78 billion) into Brazil’s stock market in August, marking the largest monthly inflow this year following six months of outflows. This was driven by growing speculation that the Federal Reserve is preparing to cut interest rates.

Brazil’s President Lula has not yet reached the midpoint of his term, and a lot can still happen. The concerns about Brazil becoming “another Venezuela” – a common worry among foreign investors when a left-leaning leader takes office in Latin America – seem to be exaggerated. While a mean reversion is likely, it may take some time to materialize.