International investors often overlook Latin America when venturing into emerging markets. Emerging market fund managers mostly focus on the potential of huge consumer markets in Asia, primarily China and India. Latin America fell off the investment radar due to the continued economic stagnation since 2014.

Global unrest is prompting investors to reassess Latin America’s investment potential. The region stands out for its lack of involvement in wars or other geopolitical conflicts, its relative insulation from the adverse effects of deteriorating globalization, and its capacity for self-reliance. Combined with attractive value propositions, these factors make Latin America an appealing de-risking destination for investment.

Latin America has developed a reputation for political instability, economic volatility, and sluggish growth. Yet, investors may consider these risks as known and manageable in comparison to the uncertain outcomes of escalating geopolitical tensions elsewhere. Is Latin America setting itself up as the “best-of-the-rest” investment destination?

Lost Decades Haunt Latin America’s Reputation

First, we look at how Latin America ended up with a tarnished reputation amongst investors. Emerging markets in general are considered riskier and more volatile. Latin America particularly has a tumultuous history plagued by military dictatorships, high levels of corruption, and economic struggles hampering growth.

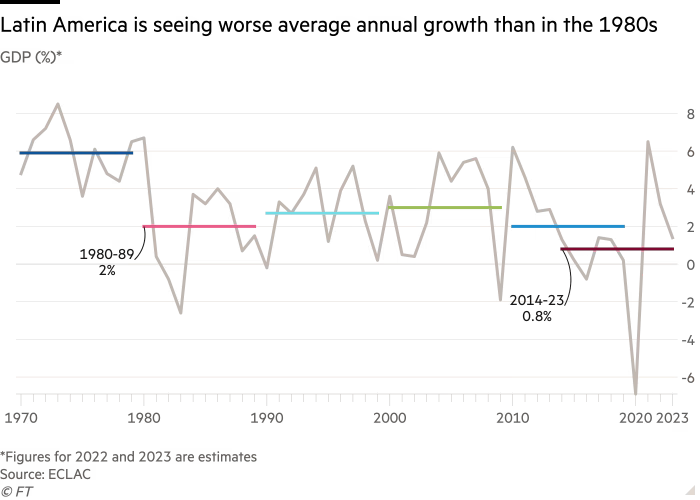

Twice, the region experienced a period of economic stagnation known as a “Lost Decade.” The first Lost Decade occurred during the 1980s, marked by a debt crisis where countries could not service their external debt and experienced hyperinflation. The second Lost Decade in Latin America spanned from 2014 to 2023 and was characterized by economic stagnation driven by declines in commodity prices and political instability.

During the Second Lost Decade, Latin America has experienced slower growth than nearly any other region. It should be taken into account that the pandemic severely impacted the area, accounting for over a quarter of global COVID-19 deaths despite having just 8.4% of the world’s population.

Despite low economic growth in the last decade, poverty and income inequality are less severe than during the first Lost Decade in the 1980s. Also, Latin America’s financial institutions learned from past mistakes and responded to pandemic stimulus with quick and prudent monetary policies. They had better success in containing inflation than peers in developed economies.

Read more on the successful monetary policy of Latin American central banks by clicking HERE!

Many Latin American nations now experience more stable macroeconomic conditions as long as the autonomy of central banks is respected. Political stability, democracy, personal freedoms, and human development indicators are significantly better than emerging market peers in Africa, the Middle East, and Asia.

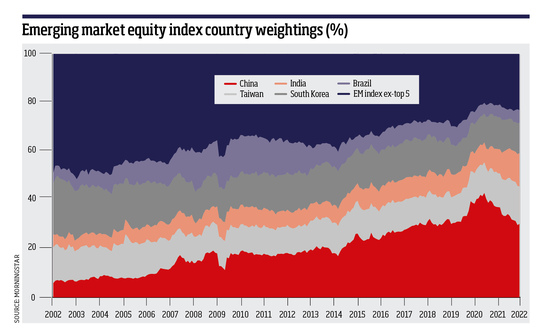

Emerging Market Investors Shift Focus Away from China

China used to have the primary focus for emerging market investors, often making up 40%-50% of emerging market benchmark indices. However, a burst in the property bubble, government crackdowns on the tech sector, and deteriorating investor sentiment reduced allocations toward China. As shown in the graph below, since the pandemic China’s weighting in emerging market indices has been on the decline.

Some investors might hope for a revival in the Chinese growth story, but there is an increasing trend of emerging markets funds excluding China from their portfolio. This is driven by the challenges facing the country due to worsening demographics, high debt levels, and the U.S.-China trade war.

The pandemic made the reliance on China as the world’s manufacturing hub evident as supply chains were disrupted. Companies are now diversifying, and this trend benefits Latin America, with Mexico’s robust manufacturing industry being a major recipient of these benefits.

Latin America Remote from Global Geopolitical Conflicts

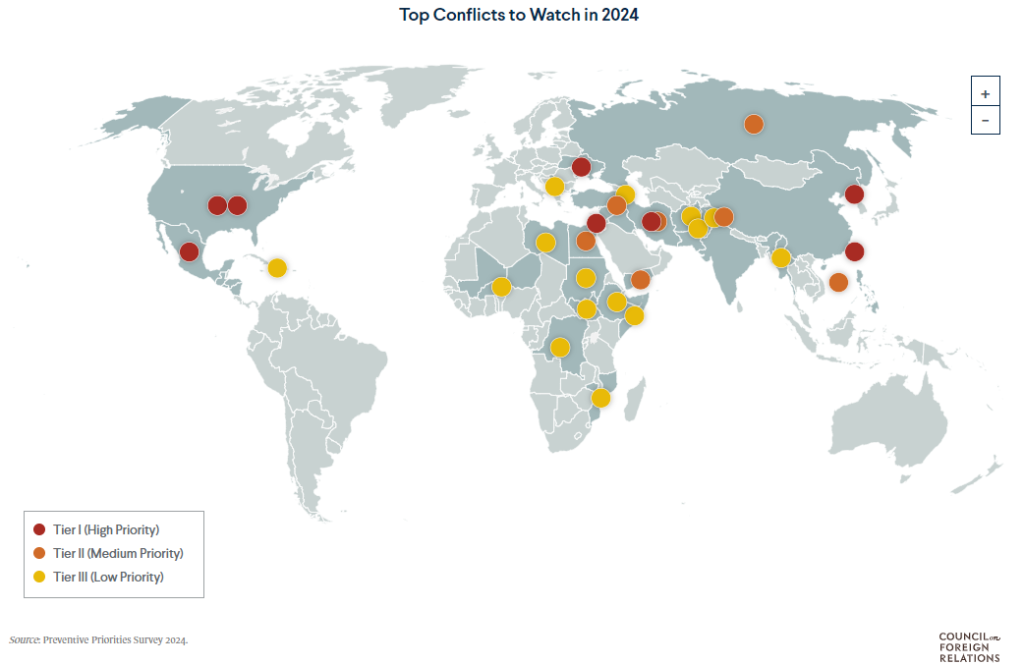

Latin America is geographically isolated and less economically integrated with the rest of the world. This caused the region to fall behind during the heydays of globalization. However, with globalization appearing to have peaked and conflicts increasing, Latin America will be less affected.

There is a rise in global unrest, with notable conflicts in Ukraine-Russia, the Middle East, and potentially Asia. In Latin America, the main concern is the increased migration towards the U.S. Southern border through Mexico. Another ongoing dispute, not shown on the map, is between Venezuela and Guyana over oil reserves.

John Moore of Morgan Stanley noted that conflicts in Europe, the Middle East, and rising tensions in Asia underscore Latin America’s crucial role in supply chains for food, industrial metals, transition fuels, and pharmaceuticals.

Latin America Shielded from China-Taiwan Conflict Impact

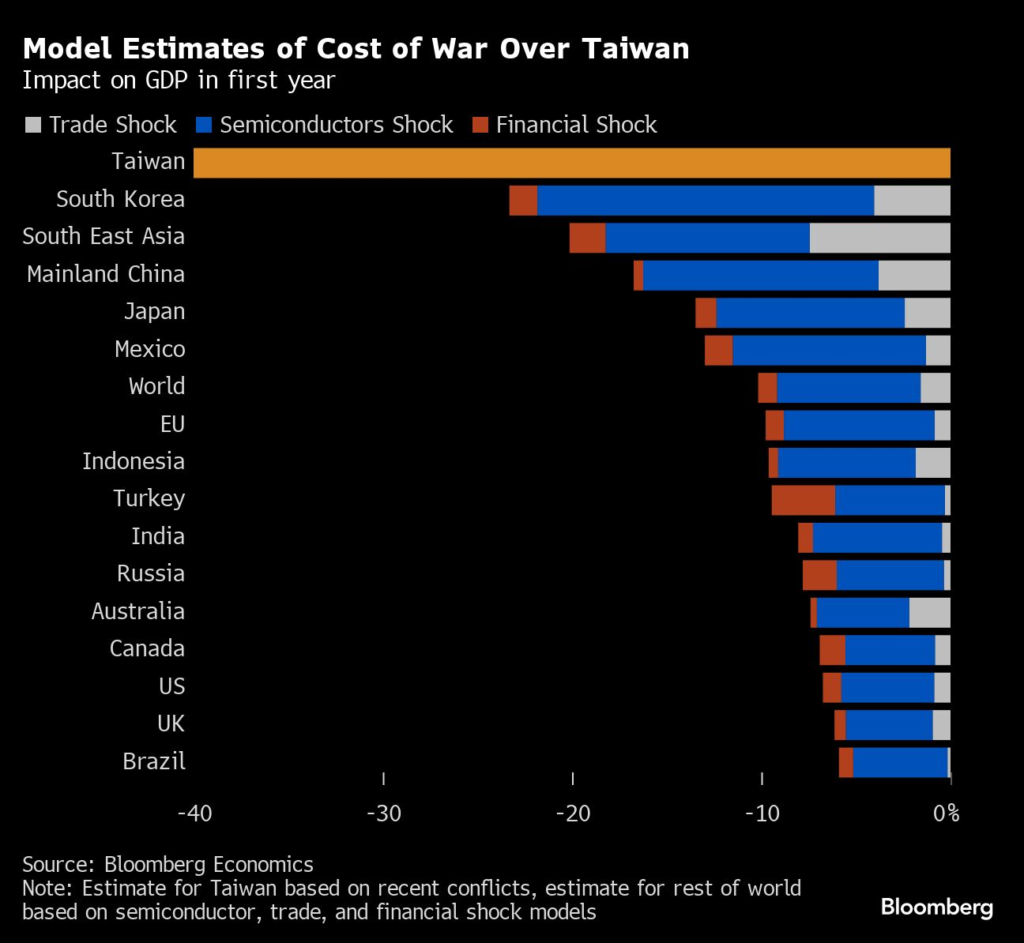

A big dark cloud hanging above the market is a potential conflict between China and Taiwan. A military invasion by China to force a unification of the countries would cost the global economy US$10 trillion, roughly 10% of global GDP. This would dwarf the consequences of the impact of the Ukraine war, the COVID-19 pandemic, and the global financial crisis.

Latin America has often been criticized for missing the globalization trend, but its lack of openness benefits the region in this scenario. Mexico would be the country in Latin America most affected by the conflict.

Nuclear War Involvement Unlikely

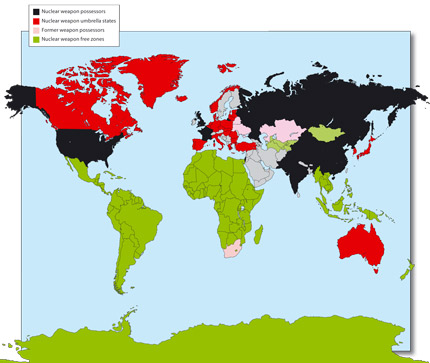

For the first time since the Cold War, the threat of nuclear conflict has resurfaced. Latin America is a nuclear-weapon-free zone. The region remains firmly committed to nuclear non-proliferation through the Treaty of Tlatelolco, signed on February 14, 1967, and enacted on April 22, 1968.

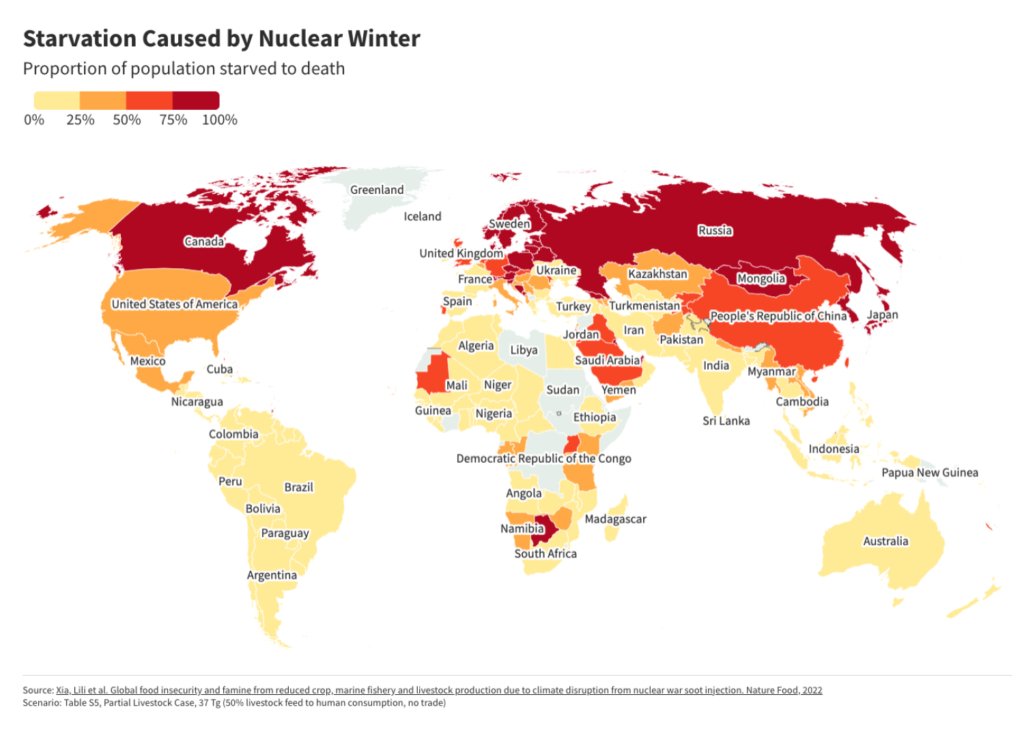

Politicians may nonchalantly discuss the use of nuclear weapons, but it must be avoided at all costs. It would put the world in a nuclear winter few would survive. The best chances to not be starved to death are in Latin America, particularly the Southern Cone.

Latin America’s Resource Curse Becomes Self-Reliance Blessing

The blessing of an abundance of resources can lead to the phenomenon where countries rich in natural resources like oil, minerals, or precious metals experience slow economic growth and development. Known as the resource curse or paradox of plenty, this often goes hand-in-hand with economic dependence on volatile commodity prices, poor governance and corruption, and neglect of other economic sectors.

With globalization past its peak, isolationism is on the rise. This is addressed in the CEO Imperative series, which focuses on critical issues and actions CEOs can take to reshape the future of their organizations, presented by EY. Policymakers pursue domestic self-sufficiency and economic security despite the higher costs involved.

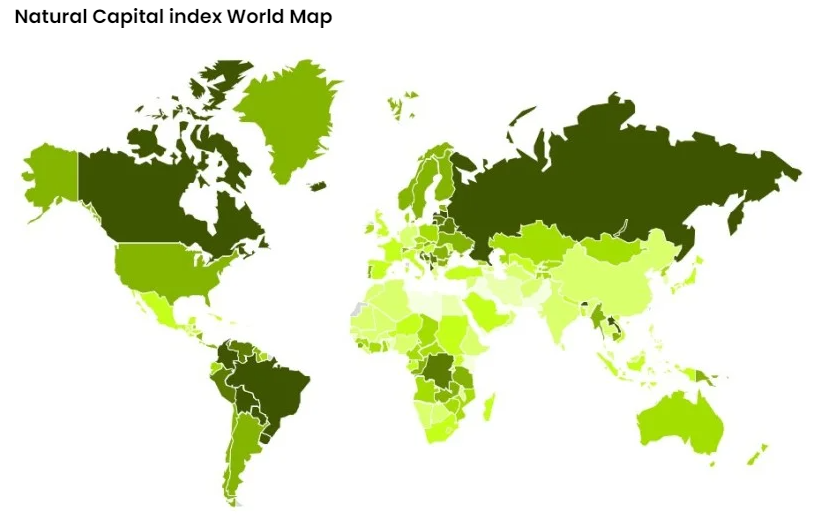

Latin America scores extraordinarily well on the Natural Capital index, which considers a country’s natural resources such as land, water, climate, biodiversity, food production and capacity, and energy and mineral resources. The assessment also considers how depletion or degradation of these resources could endanger future self-sufficiency.

Inflation rates remain high and look to be stickier than initially thought. Commodity-rich nations can offset inflation as commodity prices serve as a hedge. Extreme mismanagement in Venezuela and Argentina has led to unprecedented inflation, showing that it is not a guaranteed hedge.

Latin America Emerging as a Best-of-the-Rest Investment Hub

Calling Latin America a safe haven may be an overstatement, as the region’s issues remain unresolved. However, compared to fragility in other regions and the consequences of their conflicts, Latin America’s investment risks are relatively manageable.

In a multipolar world, regionalism is becoming more important. Latin America is well-positioned for closer integration with the U.S., the world’s largest economy. The U.S. is already investing in Latin America to secure access to increasingly scarce natural resources.

Geopolitical risk management suggests that the likelihood of conflict is lower in Latin America than in many other regions.In a rapidly changing world, Latin America appears to be relatively safe.