Coca-Cola bottlers in Latin America provide investment opportunities in Latin America’s soft drink industry. They satisfy the thirst of millions of Latinos who have developed a sweet tooth for the soft drink. This region serves as a crucial market for the brand due to its high demand and potential for growth. A few prominent bottling companies in Latin America that manufacture Coca-Cola products are traded publicly, offering unique investment opportunities.

The main bottlers for Coca-Cola in Latin America are Mexico’s Coca-Cola FEMSA (NYSE: KOF) and Chile’s Embotelladora Andina (NYSE: AKO.B) (NYSE: AKO.A). Both firms are listed on the NYSE, providing investors with direct exposure to the region’s soft drink industry. Sometimes it might be more lucrative to invest in bottlers rather than buying shares of the Coca-Cola Company (NYSE: KO).

The bottling companies operate as independent entities. They have independent management and operations, which produce and distribute Coca-Cola products under the license of the Coca-Cola Company. This article delves deeper into these entities’ operations and investment prospects.

Coca-Cola’s Strategic Partnerships with Bottlers

The relationship between The Coca-Cola Company and its independent bottling companies involves close partnership and collaboration. The Coca-Cola Company owns and markets the brands and concentrates. Independent bottling companies are responsible for manufacturing, distributing, and selling Coca-Cola products within specific geographic territories under license from The Coca-Cola Company.

These bottlers produce and distribute a variety of Coca-Cola products, including carbonated soft drinks, juices, teas, and bottled water. The Coca-Cola Company provides marketing support, brand development, and product innovation, while the bottlers manage day-to-day manufacturing and distribution operations.

Latin America’s Sweet Tooth for Soda

Coca-Cola’s position as the dominant soft drink in Latin America is undisputed. It is the most consumed soda in many Latin American countries, and in some places, it has become an integral part of the culture. After the United States, Mexico has the second-highest per capita consumption of Coca-Cola.

Read more about Mexico’s Coca-Cola consumption by clicking HERE

Although most Coke is drunk in the United States, overall soda consumption per capita is the highest in Argentina with an annual consumption of 155 liters per capita annually. Argentines enjoy Coca-Cola straight or mixed with alcoholic beverages such as fernet and sometimes even with wine.

Coca-Cola has become a household staple in Latin America for various reasons, including limited access to clean tap water, comparable prices of soda and bottled water, and successful marketing campaigns. Investors eyeing the Latin American soda market can be confident that demand for these drinks will remain strong.

The Coca-Cola Company identified most of the growth in the region coming from Brazil and Mexico. Argentina is currently struggling with macroeconomic challenges and inflationary pressures. However, there are hopes for a reversal under the new administration of President Javier Milei. Coca-Cola is found across the region, from the busy streets of its megacities to small villages in remote areas.

Investment Insights: Coca-Cola and Its Bottlers

Investing in the Coca-Cola Company or one of its bottlers offers different investment cases. The Coca-Cola Company has a lower risk profile due to its multinational status and global diversification. Its stock (NYSE: KO) is a stable and liquid investment with lower volatility.

The Coca-Cola bottlers tend to entail higher risks due to fluctuating input costs, regulatory changes, and regional instability. Limited geographic diversification makes them more susceptible to localized market conditions and competition. However, investments in bottlers operating in high-growth or underserved markets may offer higher potential returns.

Coca-Cola FEMSA, S.A.B. de C.V. (NYSE: KOF)

Coca-Cola FEMSA is the largest Coca-Cola franchise bottler globally by sales volume. It boasts 252 distribution centers, 56 production facilities, and a customer base of 272 million. Founded in 1979, its headquarters are in Mexico City. It is a subsidiary of Fomento Economico Mexicano, S.A.B. de C.V. (NYSE: FMX).

The company provides a diverse range of beverages, which includes colas, flavored sparkling drinks, water, juices, coffee, teas, dairy products, sports drinks, alcoholic beverages, and plant-based drinks. These products are readily available through various channels, such as retail outlets, supermarkets, and home delivery. Additionally, the company distributes Heineken, Estrella Galicia, and Therezópolis beer in Brazil. It operates in several countries, including Mexico, Guatemala, Nicaragua, Costa Rica, Panama, Colombia, Brazil, Argentina, and Uruguay.

Additionally, its online B2B platform, Juntos+, offers an omnichannel experience to 1.1 million traditional trade clients, aligning with its growth objectives. During 2023, digital sales amounted to an impressive $2.4 billion, accounting for 32% of all orders processed.

Coca-Cola FEMSA is indirectly owned by Fomento Economico Mexicano, S.A.B. de C.V. (“FEMSA”), which holds 47.2% of its capital stock and 56% of its voting shares, and The Coca-Cola Company, which indirectly owns 27.8% of its capital stock and 32.9% of its voting shares. Its American Depositary Shares (ADS) trade on the New York Stock Exchange as series B, representing 9.4% of the company’s common equity.

Embotelladora Andina S.A. (NYSE: AKO.A) (NYSE: AKO.B)

Embotelladora Andina S.A. (NYSE: AKO.B) (NYSE: AKO.A) is the leading Coca-Cola bottler in the Andean region with 95 distribution centers, 15 production facilities, and a customer base of 57,4 million. Founded in 1946, its headquarters are in Santiago de Chile.

The company offers a variety of beverages, including fruit juices, flavored waters, sports drinks, hard seltzers, ice tea, pre-mixed cocktails, and alcoholic beverages like Campari, Aperol, and Skyy. It also distributes energy drinks, wine, cider, spirits, ice cream, confectionery, and beer under various brands. These products are mainly sold through small retailers, restaurants, supermarkets, and wholesale distributors. It operates in Chile, Brazil, Argentina, and Paraguay.

Embotelladora Andina has been listed on the New York Stock Exchange since 1994 under the tickers AKO.A and AKO.B. Each American Depository Receipt (ADR) represents six common stocks. Despite comprising only 2.90% of the total issued shares, ADRs trade significantly more than the stock listed on the Santiago Stock Exchange.

Both Series A and Series B shares are preferred shares and have no par value. Series A shares have the exclusive right to elect twelve out of the fourteen board members of the Company and possess full voting rights without restrictions. Series B shares are entitled to receive all dividends per share distributed by the Company, with a 10% increase. They have limited voting rights, participating only in the election of two board members.

Factors to Consider When Evaluating Coca-Cola and Its Bottlers

The Coca-Cola Company (KO), Coca-Cola FEMSA (KOF), and Embotelladora Andina (AKO.A/AKO.B) vary significantly in size. The Coca-Cola Company has a market cap of $270.88 billion, Coca-Cola FEMSA has a market cap of $21.24 billion, and Embotelladora Andina has a market cap of $2.60 billion. Each company thus has different levels of liquidity, volatility, and risk profile.

The Coca-Cola Company (KO) is a global company with significant geographic diversification. In contrast, Coca-Cola FEMSA (KOF) primarily operates in Latin America but has a widespread presence across numerous countries. However, Embotelladora Andina (AKO.A/AKO.B) operates in only a few countries in Latin America, resulting in limited diversification.

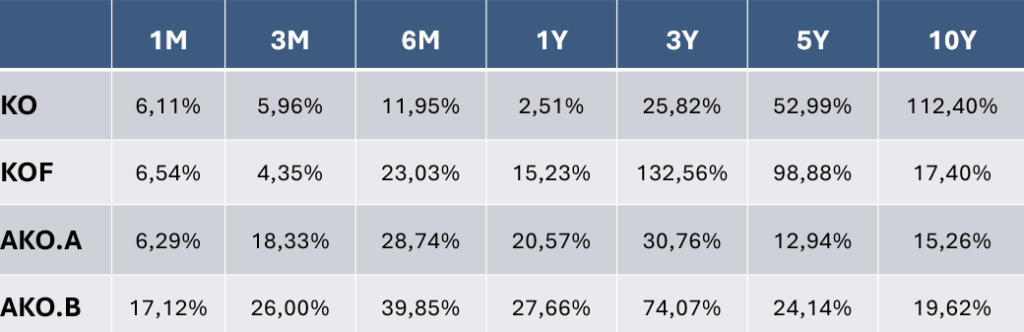

The results above demonstrate that the performance of stocks varies significantly across different timeframes. Although The Coca-Cola Company (KO) showed the highest returns over the 10-year timeframe, it has recently been a less profitable investment. In the 3-5 year midterm timeframe, Coca-Cola FEMSA (KOF) has generated the best returns. On the shorter timeframe, Embotelladora Andina (AKO.A/AKO.B) has shown strong returns.

Invest Proactively in LatAm’s Coca-Cola Bottlers

Investing in Coca-Cola bottlers in Latin America, such as Coca-Cola FEMSA and Embotelladora Andina, demands a proactive approach compared to a straightforward investment in The Coca-Cola Company (NYSE: KO). Savvy investors can leverage market volatility and strategic timing to achieve superior returns, keeping in mind that higher risks often come with higher rewards.

Regional events can significantly influence investment returns. For instance, a potential economic recovery in Argentina could greatly benefit Embotelladora Andina (NYSE: AKO.A, NYSE: AKO.B), which derives a substantial portion of its revenue from this market. The recent strong performance of Embotelladora Andina’s stock may already be reflecting optimistic expectations for Argentina’s economic outlook.