Welcome to the series dedicated to turning overlooked hidden gems in Latin America from concealed to revealed. Throughout this series, we shed light on the untapped potential of lesser-known companies from the Latin American markets.

Lavoro is the leading distributor of agricultural inputs in Brazil. It aims to provide small and medium-sized farmers throughout Latin America with the resources and cutting-edge technology to enhance their productivity. The Latin American agricultural inputs market is currently undergoing consolidation. Lavoro aims to secure a leading position and build a moat within the industry.

Company Overview of Lavoro

Founded in 2017, Lavoro offers agricultural supplies and solutions including fertilizers, pesticides, seeds, and crop protection products. It became the first US-listed pure-play Latin American agricultural inputs distributor through a SPAC in 2022. Lavoro is listed on the NASDAQ under the ticker LVRO.

Lavoro quickly emerged as a key player in Latin America’s agricultural sector through strategic acquisitions of over 25 small- and medium-sized companies. Its extensive network of 215 distributors serves over 72,000 farmers across Latin America who are provided with the latest knowledge and technologies to operate successfully.

The company serves as a significant employer in the region, with a workforce exceeding 3,000 employees. Crucial for the business’ expansion are over 1,000 technical sales representatives (RTVs) who are instrumental in guiding farmers through critical decisions spanning the entire crop cycle.

Products & Services

Lavoro’s subsidiary companies operate an extensive distribution network of agricultural inputs, which has been built through strategic mergers and acquisitions. This has resulted in a strong regional presence for distributing essential agricultural inputs.

In addition to distribution, Lavoro maintains its own production line of agricultural products. This vertical integration enables the company to exercise greater control over quality, pricing, and supply chain efficiency. Consequently, it enhances Lavoro’s competitiveness in the market.

Furthermore, Lavoro provides various value-added services, including technology consultancy and insurance solutions. By offering these services alongside its core products, Lavoro aims to meet the diverse needs of its customers. It seeks to enhance its value proposition and strengthen customer relationships. Additionally, farmers are provided with an all-encompassing solution to their farming activities.

Segments

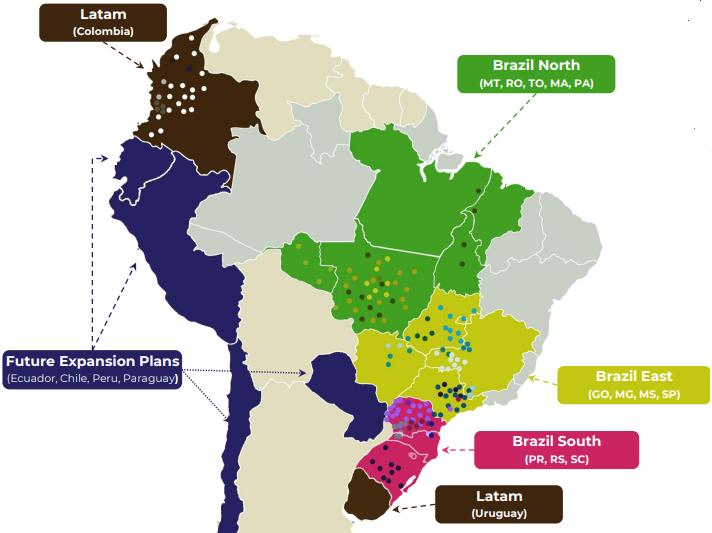

Lavoro boasts a substantial geographical presence across major agricultural hubs in Latin America, with operations spanning Brazil, Colombia, and Uruguay. In Brazil, the footprint extends across several states, with significant positions in key agricultural centers including Mato Grosso, Paraná, Minas Gerais, Mato Grosso do Sul, Rio Grande do Sul, and São Paulo.

Lavoro serves as the vital distributor of agricultural inputs across 30 states in Colombia. Furthermore, it has an emerging agricultural input trading enterprise in Uruguay. Looking to the future, the company has expansion ambitions to other South American countries such as Peru, Chile, Paraguay, and Ecuador.

The Group’s reportable segments are the following:

- Brazil Cluster: comprising companies located in Brazil that sell agricultural inputs in Brazil. Due to the size of Brazil and regional differences, the market is split into North, East, and South. Each region has its own sales approach, but negotiations with suppliers are done on a central level to benefit from economies of scale.

- LATAM Cluster: comprising companies dedicated to distributing agricultural inputs outside Brazil (currently primarily in Colombia).

- Crop Care Cluster: comprising companies that produce and import their own portfolio of proprietary products including off-patent crop protection and specialty products (e.g., biologicals and specialty fertilizers).

Latin America Market Place

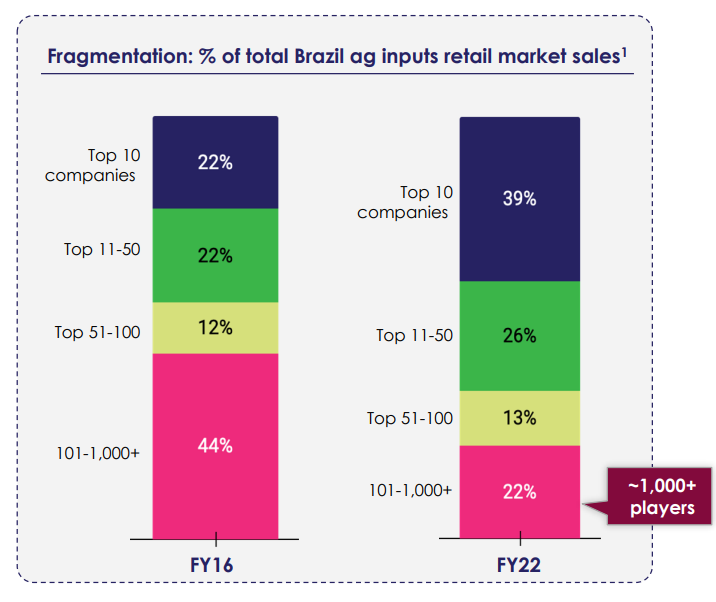

South America’s agricultural retail market remains fragmented, marked by numerous small, family-owned businesses passed on through generations. In contrast, the North American market has consolidated into five key players. Lavoro now owns approximately 10% of the market but wants to grow its share as the first wave of consolidations is hitting the market.

Small and mid-sized farmers in Latin America miss the same access to cutting-edge technologies as large farmers. Lavoro bridges this technology gap to help farmers maximize production on the same land space. Latin American agriculture is at a turning point, driven by new technologies reshaping the global market, with three key trends—digital, genome engineering, and biologicals—maximizing productivity, sustainability, and cost reduction.

Small and mid-sized farmers in Brazil occupy about 65% of the agricultural land in the country. The success of small-scale farming operations is crucial for the country’s food production and food security. Due to land ownership and the ability to grow two or three crops annually thanks to the climate, Brazilian farmers have been more profitable than their counterparts in the US. The profitability rate ranges between 35% to 40% compared to 4% to 5% in the US.

Lavoro’s Pillars for Growth

Many smaller farmers in Brazil lack the financial resources to acquire land but want to maximize yield on their acreage. Lavoro provides them with the technical know-how and resources to achieve this. The consolidation in the agricultural inputs market in South America provides Lavoro with numerous opportunities to grow as a dominant player in the sector. The company has identified four long-term growth pillars:

1. Market Expansion

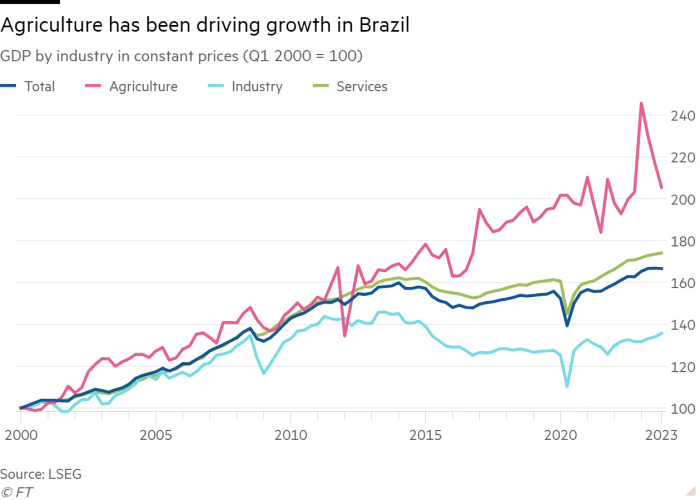

The COVID-19 pandemic and the conflict between Russia and Ukraine have exposed the fragility of global food supply chains. Latin America can become a stable supplier of agricultural commodities to feed the world. Brazil already ranks among the top five producers of 34 commodities and is the largest net exporter in the world.

The country aims to continue trade expansion and product diversification in agricultural products to sustain its growth momentum. Technological advancements and increased acreage will reinforce the upward trajectory in yield. Lavoro anticipates a continued expansion of its total addressable market (TAM) in the foreseeable future.

2. Grow Regional Footprint

Its growth efforts have mainly come from its experienced M&A team which has delivered tangible results in revenue and EBITDA synergies post-acquisition in Brazil. The large proprietary deal flow extends beyond Brazil, encompassing an active pipeline throughout South America to foster regional consolidation. The chart below illustrates significant growth potential for Lavoro despite market consolidation.

(1) Chart represents the sales % share in the crop protection and seeds market. Excludes co-operatives and global suppliers that sell directly to large farmers.

Lavoro also employs organic store openings to expand its footprint. Through strategic store openings, the company can penetrate local markets effectively and strengthen its presence in key regions. This multi-faceted approach underscores Lavoro’s commitment to sustainable growth and market leadership in the agricultural retail sector.

3. Add Clients

RTVs leverage their extensive knowledge of clients’ agronomic history, to provide tailored guidance on technical matters, local growing conditions, and pest monitoring. Personalized recommendations tailored to address the specific needs and challenges of farmers help to strengthen customer loyalty.

The expertise of RTVs spans seed selection, pest management, and irrigation strategies. Furthermore, they are provided with cutting-edge tools and resources, leading Lavoro to set a new benchmark for excellence in technical sales. Recently, the company hired more experienced RTVS to enhance the company’s business development in the upcoming period.

4. Platform Differentiation

Crop Care provides a range of product categories tailored to farmers’ needs, including biologicals, specialty fertilizers, and agrochemicals. There are cross-selling opportunities via Lavoro to capitalize on the growing adoption of specialties.

Although soil testing and analysis are common practices in the US, these practices are relatively uncommon in Brazil. There is potential to introduce advanced soil testing technology to Brazil through partnerships with Pattern Ag and Stenon.

Lavoro’s RTVs will use the data analysis from Pattern Ag and Stenon to create customized agronomic treatment plans. This allows for promoting Crop Care biologicals, which will enhance agronomic outcomes in conjunction with RTV recommendations and improve customer satisfaction.

Risks to Take into Consideration

There are a lot of variables impacting the operations of agribusiness, making the industry subject to volatility. Factors to consider are the seasonality of crop cycles, extreme weather fluctuations (e.g., caused by the El Niño phenomenon), diseases or plagues, and price volatility of commodities. A company such as Lavoro should be able to deal with such business risks inherent to the industry.

The rapid growth in Brazil’s agricultural sector could significantly affect Lavoro’s growth aspirations, especially with more structural developments taking place. This growth raises questions about its sustainability and potential risks, such as the destruction of large parts of the Amazon rainforest for agricultural land and increased dependence on China’s demand for Brazil’s exports.

Balancing Wealth and Ecology in Brazil’s Agribusiness Boom

Under Bolsonaro’s government, agribusiness flourished attracting numerous fortune seekers to the frontier between rainforest and agriculture. The pursuit of wealth in the agricultural sector has also been referred to as the “green gold” rush. International pressure has risen as the deforestation of the Amazon rainforest increased to make room for pastures.

The golden age for agribusiness under Bolsonaro tolerated practices such as deforestation and land grabs. Lula is breaking with this policy, pushing the sector to more “modern agriculture” for a sustainable future. Thereby, Lula will need to conduct a delicate balancing act of meeting the expectations of his leftist supporters and managing the concerns of right-wing parties allied with agribusiness.

Part of the sector staunchly opposes Lula’s environmental and social directives, including Amazon preservation and land redistribution. Nonetheless, both parties have made concessions to form a workable relationship for now. The rapid growth in agricultural developments through obtaining acreage seems to be in the past.

China’s Impact on Brazil’s Agricultural Future

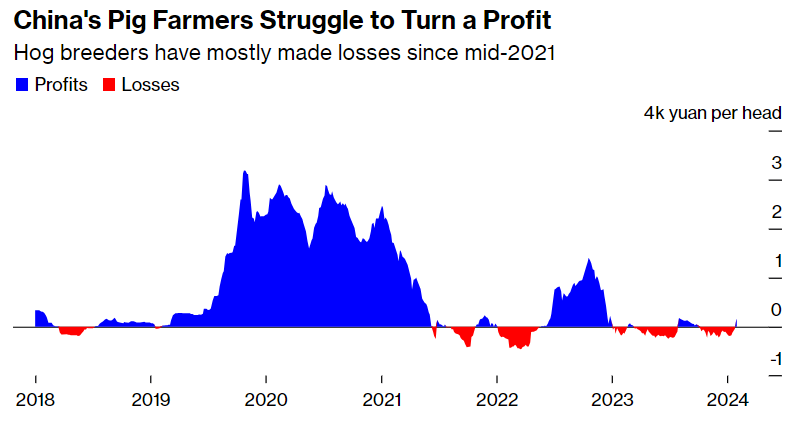

Brazil heavily relies on China for the demand of its agricultural exports. Soy is one of those agricultural products which has been in high demand by China to feed its huge pig stock for the domestic pork consumption. China’s pork consumption per capita is twice the world’s average and accounts for approximately 46% of total global pork consumption.

China is home to the largest number of pigs with over 450 million heads in 2023 to feed the domestic pork consumption. Brazilian soybean is used to fatten up these pigs. The export of Brazilian soybeans to China peaked in 2018 at 82% and has averaged 73% from 2019 to 2023. Brazil’s soy industry is vulnerable for a “black swan” event occurring such as an outbreak of African swine fever.

In recent times, the Chinese economy has been faltering, marked by declining wages and reduced consumption. The demand for luxury items like pork has been sluggish, resulting in an oversupply. This adds to China’s worrying deflation situation, notably in the food sector, where pork plays a significant role. Since mid-2021, pig farmers have faced challenges in turning a profit.

Furthermore, China’s demographics keep deteriorating as the population fell for a second consecutive year in 2023. The declining birth rate reflects the lack of optimism among young Chinese about the future. If this population decline persists, it will have long-term repercussions on Brazil’s agricultural sector.

Lavoro’s Agribusiness Journey Continues

Lavoro stands at the forefront of transforming Latin America’s agricultural landscape. It leverages strategic acquisitions, innovative solutions, and a commitment to empowering small and medium-sized farmers. Lavoro provides essential agricultural inputs through its extensive distribution network and vertical integration. It also offers value-added services and technology consultancy to meet the diverse needs of its customers.

However, amidst its promising trajectory, Lavoro faces risks inherent to the agribusiness industry. These risks include seasonality, extreme weather fluctuations, and commodity price volatility. Furthermore, the company navigates complex socio-political dynamics. These dynamics involve environmental concerns and international trade dependencies, particularly with China.

The company’s growth pillars highlight its dedication to sustainable and competitive growth. Lavoro contributes to the resilience and prosperity of Latin American agriculture by bridging the technology gap and enhancing productivity. Through strategic foresight and adaptability, Lavoro remains poised to navigate challenges and seize opportunities.