A changing macroeconomic environment has led investors to diversify their portfolios into emerging markets, evidenced by increasing capital inflows. The Latin American region has benefitted from this trend, although the existing offering of investment vehicles to the region is limited. Historically overlooked, Latin American markets receive little attention.

Financial institutions have not adequately monitored developments in Latin American markets, leading them to miss out on opportunities in the region. The current product offering of ETF providers to invest in Latin American markets does not meet the increased demand from investors. Furthermore, the existing Latin America ETFs do not capture the technological revolution disrupting traditional industries in Central and South America.

This article will reflect on the current state of the market and product offering of (passive) investment vehicles to invest in Latin America. The focus will be on exchange traded funds (ETFs) as this is a growing market in fund investing.

ETF Industry Grows Despite Global Challenges

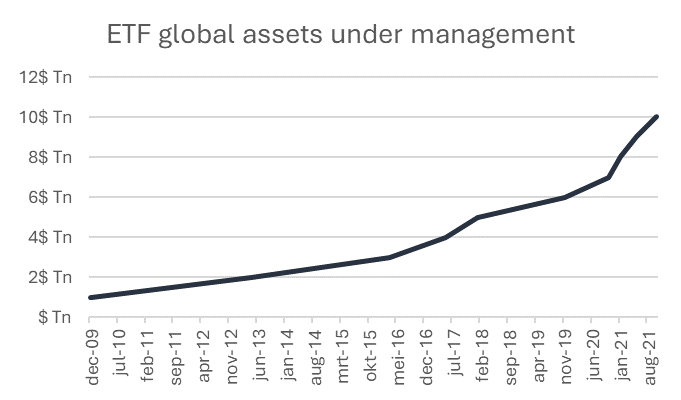

Exchange traded funds (ETFs) have disrupted the investment industry providing millions of investors with an easy and affordable way to diversify their investment portfolios. The pooled investment security tracks indices, commodities, or other asset classes with the same conveniences as trading a stock. The ETF sector has rapidly expanded within a short timeframe. From December 2009 to November 2021, the industry grew from $1 trillion to $10 trillion.

Despite the financial markets facing challenges in 2022, the demand for ETFs has remained robust. The industry witnessed its second-highest global net inflow on record, amounting to $867 billion. This marked a decrease from the peak in 2021 when net inflow amounts reached $1.29 trillion. Notably, equity ETFs experienced a decline, dropping to $598 billion compared to $1 trillion in 2021. Within this context, emerging market equity ETFs attracted substantial inflows, totaling $110 billion and constituting 18.4% of equity ETF investments, making it a significant year for emerging markets.

Latin America on Investors’ Radar

Latin American markets started to catch the attention of investors as their economies have remained relatively stable despite rising global inflation, interest rate hikes by the Federal Reserve (FED), and the strengthening of the US dollar. The region’s resilience can be attributed to the prudent monetary policies of various Latin American central banks, which involved early and aggressive interest rate hikes, shielding the region from the typically adverse effects of such a macroeconomic environment.

In a previous article, we dissected the groundbreaking policies fueling the success of central banks in Latin America. Get to know more by clicking here!

Issues causing the years-long lack of attention for the region, such as a slowdown in commodity prices, corruption scandals, and political upheaval, seem to have been forgotten for now. Latin America missed the boat on economic expansion through globalization but is starting to attract investor attention as an inflation-hedge through its commodity-driven economies.

Emerging market fund managers might remain dedicated to continuing to favor gigantic consumer markets in China and India due to their promised bright prospects for attractive returns. Despite their strong bias, the inflow in Brazilian ETFs was €1.3bn, only being outperformed by China (€3.6bn) in terms of the largest single-country market flows.

Although this is an astonishing performance, there seem to be some inefficiencies in the Latin American ETF offerings. As Latin American markets are suddenly up for discussion again, investors will look for passive investment strategies such as ETFs to increase exposure to the region. Only a few ETFs provide exposure to Latin American markets and do not seem to capture the full spectrum of investment possibilities and appetite in the market.

EM Index Composite Favors Asia over Latin America

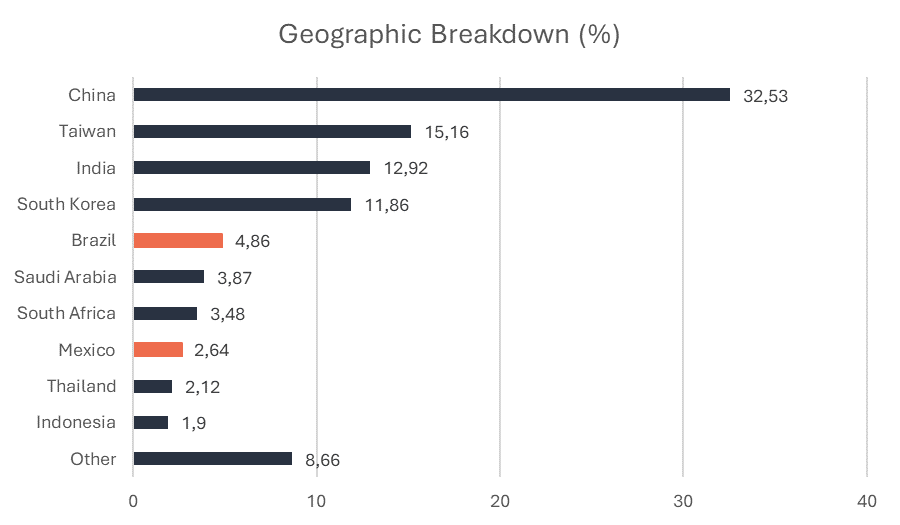

The main emerging market ETFs provide slim exposure to Latin America as geographic allocation to the region generally does not surpass 10% of the benchmark index due to stiff competition with mainly Asian counterparts. Fund managers are attracted to larger size, better liquidity, and lower volatility of the Asian market.

Large populations in China and India provide for large consumer markets. Taiwan and South Korea have globally leading companies in technological advancements. It is contested whether they even belong to the emerging market category with their high level of development. Closing the ranks are Saudi Arabia in the Middle East, South Africa for the African continent, and Southeast Asian nations such as Thailand and Indonesia.

Morgan Stanley has concluded that the Latin American markets are trading at attractive valuations and are likely to perform better than the broader emerging market index. The bank is particularly confident about Brazil and Mexico. The graph below illustrates that Brazil and Mexico comprise only 7.50% of the iShares Emerging Market ETF, providing limited exposure.

LatAm ETF Sector Still Tilted Toward the “Old” Economy

The modest scale of Latin American equity markets is attributed to the fact that the majority of companies are privately owned. Most Latin American countries have low-trust societies where founders struggle to share ownership with a public audience they do not know. The digitalization trend in the region has led to an increase in tech companies going public.

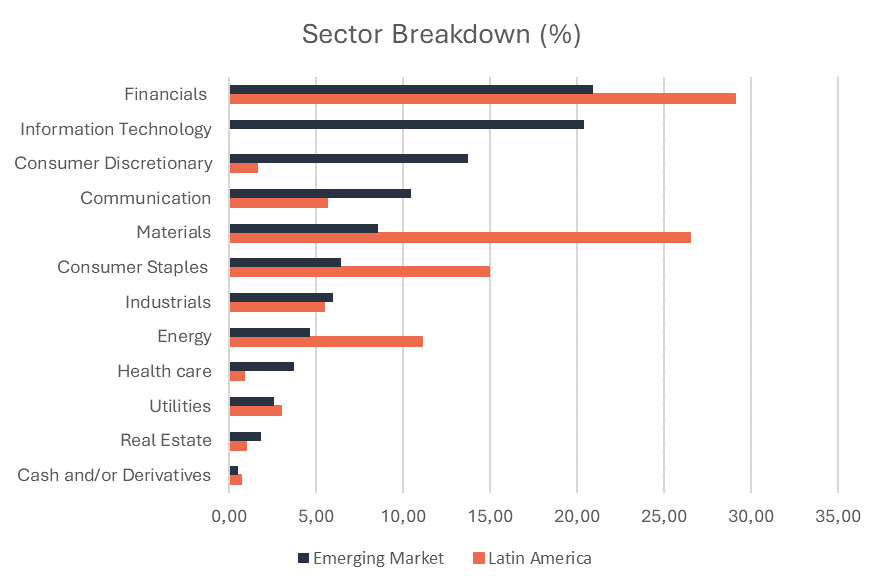

The existing offering of ETFs tracking Latin American ETFs does not reflect the digitalization trend. Latin American ETFs lag in reflecting the digitalization trend, with a continued emphasis on the “old” economy, primarily in materials, financials, and commodities.

The benchmark index overlooks recent advancements in e-commerce, fintech, and edtech. Notably is the exclusion of the flourishing e-commerce giant MercadoLibre from the index despite its substantial market capitalization and remarkable growth in recent years.

Argentina seems to have been excluded from the index, even though several tech giants in Latin America operate out of the country. The only significant company included in the benchmark index reflecting the digital transition in the region is Brazilian fintech Nubank. The only notable company reflecting Latin America’s digital transition in the benchmark index is Brazilian fintech Nubank.

Exploring Untapped Potential: Tech Companies in Latin America ETFs

The MSCI Latin America 10/40 Index has zero exposure to the information technology sector. EMQQ Emerging Markets Internet & Ecommerce UCITS ETF is an ETF focussing on the digitalization trend in emerging markets. While this ETF includes certain publicly traded tech companies in Latin America, they constitute only 9% of its underlying benchmark.

The bulk of the Latin American weighting in EMQQ comes from MercadoLibre, which makes up 6% of the underlying index. Another Argentine company, Despegar, is also represented in the index. Other tech-driven companies in Latin America include fintechs such as Brazilian Inter & Co and StoneCo (supported by Warren Buffet).

Investing in the region’s digitalization through ETFs appears feasible. The information technology sector in the region is a niche market and probably too small for a dedicated ETF exclusively on Latin American tech companies. Nonetheless, this prompts the question of why these tech companies are not in the underlying index of broader ETFs on Latin American economies.

ETFs should better reflect the economic reality in LatAm

Increasing capital inflows in emerging market equity ETFs indicate the interest of investors to diversify away from developed markets. Also, Latin American markets have benefitted from this trend as equity ETFs experienced increased inflows. Particularly, Brazil benefitted from this development.

Latin American markets are well-positioned due to stable monetary policy by central banks and high exposure to inflation-hedging industries. The region is also experiencing digitalization in fintech and e-commerce, but Latin American equity ETFs do not reflect this trend.

As the ETF sector expands, Latin America stands to gain from ETFs that more accurately reflect the economic advancements in the region. Presently, several of the most innovative companies in the area are not encompassed in the benchmark index, resulting in missed opportunities. A broader investor base could become attracted to the region if ETF providers integrate the technological revolution in Latin America into their investment offerings.