Investing in emerging-market subsidiaries of large multinationals provides the opportunity to capture unique, country-specific growth potential. Multinationals list subsidiaries in local markets to strengthen market presence and access local capital. In Latin America specifically, the stocks of subsidiaries of Spanish superbanks offer investors a direct pathway to tap into these market-specific growth opportunities.

To this day, Spain’s historical connection with Latin America and its mostly shared language has led to Spanish multinationals operating in the region. Locally traded subsidiary stocks remain rare, but the major Spanish banks—Banco Santander and BBVA (Banco Bilbao Vizcaya Argentaria)—offer exposure to three key countries: Argentina, Brazil, and Chile.

With a strong investment thesis, investors can gain exposure to the growth potential of these markets through the listings of subsidiary banks, which often trade at more attractive valuations than their parent companies. These deep-value investment opportunities are relatively scarce and carry some risk. However, they can be worth the risk if there is a positive turnaround in a country’s economic trajectory.

Banco BBVA Argentina S.A. (BBAR)

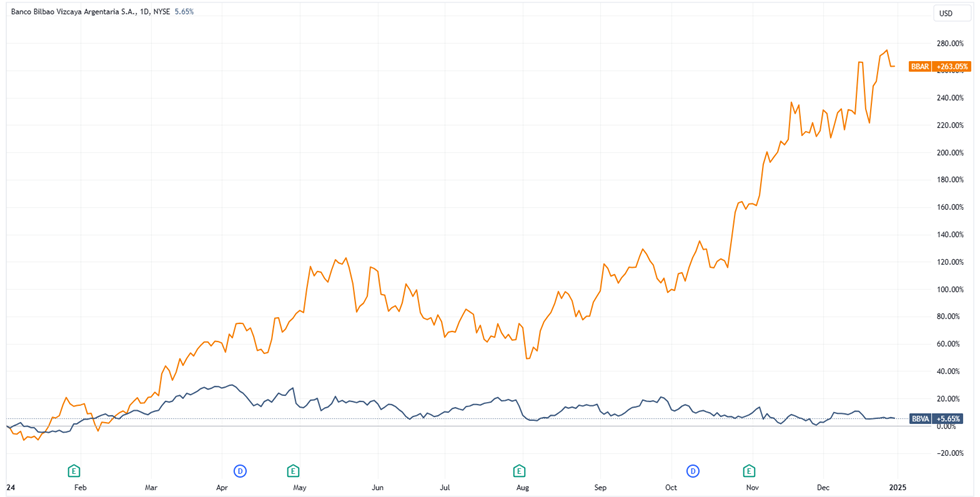

An Argentine subsidiary of BBVA, Banco BBVA Argentina S.A., is a recent example of how country exposure can boost investment returns. The contrast between parent and subsidiary performance tells a compelling story: Spain’s BBVA (BBVA) delivered a solid 74.2% return over five years, including a 5.7% gain in the past year. However, its Argentine unit, Banco BBVA Argentina (BBAR), dramatically outperformed with a 258.9% five-year return and a 263.1% surge in the last twelve months alone.

The outperformance stems from shifting market sentiment regarding Argentina’s economic prospects. Years of economic mismanagement had pushed inflation to near-hyperinflation levels. Government-imposed capital controls prompted MSCI to downgrade South America’s second-largest economy from emerging to frontier market status.

Unloved and forgotten by most, cheap valuations attracted contrarian investors betting on a recovery story. Vista Capital, a Rio-based Brazilian hedge fund, took advantage of the opportunity to initiate a small position in Argentine financials (whether BBAR was included is unclear) ahead of the August primary elections. This event-driven approach relied on the expectation that a potential regime change and fiscal reforms would lead to significant asset re-pricing, with the rewards outweighing the risks.

Banco BBVA Argentina, repeatedly honored as the “Best Bank in Argentina” by prestigious international financial publications like Euromoney and The Banker, illustrated how deeply discounted valuations in out-of-favor markets can offer substantial upside potential for investors willing to take calculated risks on fundamental improvements.

Those who bought after the COVID-19 pandemic dip, when BBAR was priced around 2,5 dollars, are close to having a ten-bagger. It is truly remarkable for a country long ignored by investors.

Banco Santander-Chile

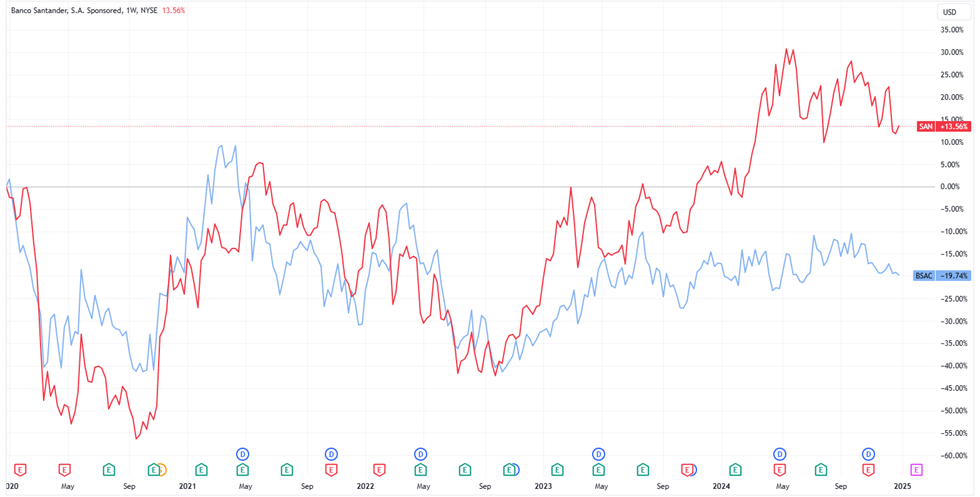

In Chile, Banco Santander’s subsidiary (BSAC) dropped 19.7% over the past five years and fell 2.9% in the past year. In contrast, the parent company, Banco Santander (SAN), delivered a 13.6% return over the past five years, including a 9.4% rise last year. This contrast highlights the differing dynamics between the parent and its regional operations, with the Chilean unit facing greater challenges in a tough economic environment.

Since Gabriel Boric was elected president in 2021, Chile’s stock market has remained flat. Boric, one of the youngest presidents in the country’s history elected at just 35, was elected on a platform of addressing inequality, improving social services, and tackling climate change, which resonated with many voters, particularly the younger generation. However, his progressive agenda has struggled to deliver tangible changes, leading to less favorable reception from financial markets.

Despite a challenging economic environment in Chile, Banco Santander Chile reported strong financial results for the third quarter and the first nine months of 2024. The bank’s net income grew by 11.7% from the previous quarter and 81.9% year-to-date, fueled by higher interest income and an increase in fees. While the bank faced some challenges with loan quality, its focus on expanding digital services and supporting small businesses helped maintain its growth trajectory.

Banco Santander Brasil

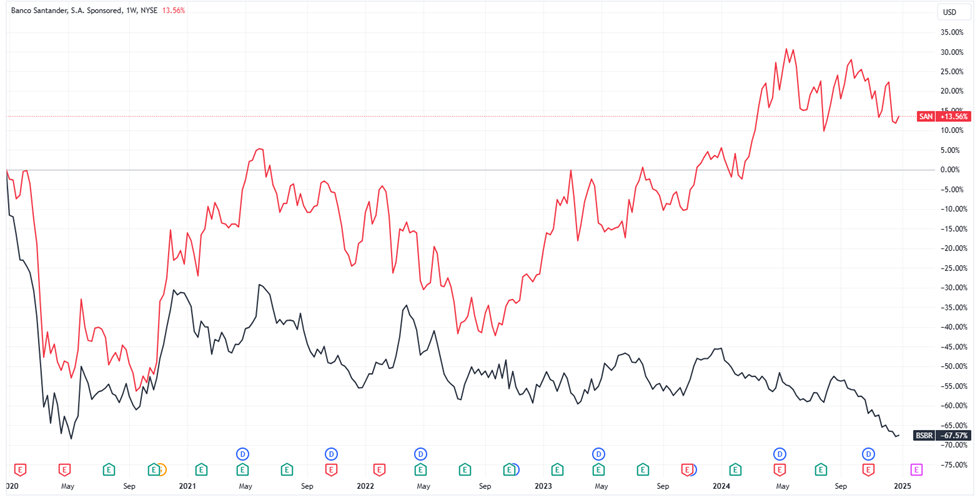

While some emerging market subsidiaries can outperform their parent companies, Banco Santander Brasil (BSBR) illustrates the potential downside of such investments. The Brazilian unit has seen its value erode significantly, with a 67.6% decline over five years and a sharp 39.3% drop in the past year. This stark underperformance, creating a valuation gap with its parent company Santander, serves as a sobering reminder of the risks inherent in subsidiary investments.

Brazil’s persistent economic challenges continue to weigh on market sentiment. Despite being Latin America’s largest economy, the nation struggles to realize its long-promised potential, perpetuating its reputation as the eternal “country of the future”. The current administration’s expansionary fiscal policies under President Lula have raised concerns among investors, while the Brazilian real’s depreciation past the psychological barrier of 6 reais to the US dollar has further dampened market confidence.

These headwinds have transformed Brazil from a favored emerging market destination to one of the least popular investment themes in the developing world, highlighting how macroeconomic and political factors can significantly impact subsidiary performance, regardless of the parent company’s global standing.

Despite a 34.3% rise in Banco Santander Brasil’s net profit for Q3, with growth in its loan portfolio and improved efficiency, broader economic concerns overshadow these positive results. The bank’s restructuring efforts and focus on customer service haven’t been enough to lift its stock price, as negative sentiment about Brazil’s economic outlook continues to dominate the investment landscape.

Contrarian investment approach

The remarkable returns from Argentine investments demonstrate the potential rewards of contrarian investing – or as the famous Wall Street saying goes, “buying when blood is in the streets.” However, executing this strategy is far more challenging than it sounds.

Contrarian opportunities often arise during times of widespread pessimism and negative headlines. Brazil’s ongoing economic challenges are a prime example, dominating financial news. However, investing in such volatile markets while the downward momentum continues carries the risk of “catching a falling knife” – a cautionary tale against rushing to buy at the bottom.

Conversely, Argentina now generates headlines for its economic revival story. While its turnaround has rewarded early investors handsomely, three years of substantial outperformance might give pause to those wary of heights. Market veterans know that identifying the peak of a bull run is as challenging as calling the bottom of a bear market.

This dynamic suggests a more nuanced approach: considering markets that fly under the radar, like Chile. The country’s current administration, led by President Boric, is approaching its final year with the lowest economic growth since Chile’s return to democracy. However, the rising popularity of right-wing political parties – traditionally viewed favorably by financial markets – could signal an inflection point. Yet unlike its neighbors, Chile’s situation generates little international media attention, potentially creating a less crowded opportunity for thoughtful investors.