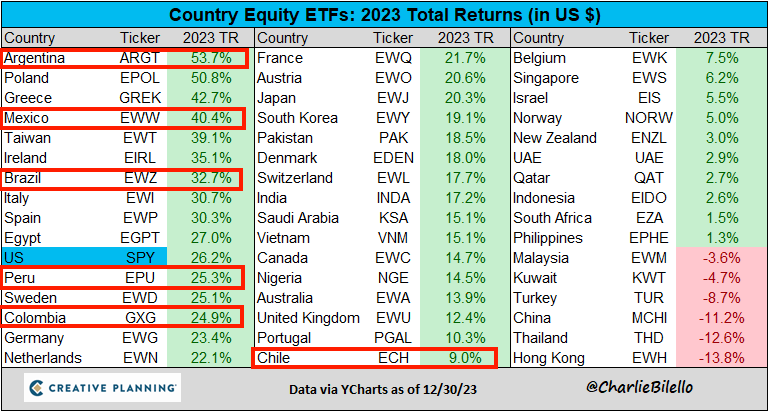

Latin America’s market showed impressive performance last year, catching the attention of a broader investment audience. Despite a rocky start in 2024, potential drivers for multi-year returns are the onshoring trend and macroeconomic factors. Investors eyeing the promising prospects of the region can turn to Latin American exchange-traded funds (ETFs).

To invest in Latin America with ETFs, one can choose ETFs focused on the region or country-specific ETFs. ETFs that target the broader Latin American region provide exposure to multiple countries within Latin America. Country-specific ETFs allow investors to capitalize on a certain country’s unique growth drivers and economic conditions within Latin America.

As the world transitions to a multipolar global landscape, investors will require a more specific investment approach towards emerging markets and Latin America. This article delves deeper into investing in Latin America via ETFs. It will explore the opportunities, challenges, and potential rewards that await those who dare to venture into this exciting market.

Time for a Nuanced Approach to Emerging Market Investing

Emerging markets is a catch-all term encompassing a vast and diverse array of rapidly growing and developing economies home to over 80% of the world’s population. Each economy is unique in the global context due to its distinct characteristics and challenges. As the world shifts to a more multipolar global landscape, lumping all emerging markets together will not suffice.

The world is continuously changing due to the shifting of regional economic powerhouses and changing geopolitical dynamics. Investors should recognize the importance of adopting a more selective and regional investment strategy to capitalize on specific market dynamics and regional trends. However, it’s crucial to acknowledge the nuances, such as encountering smaller and less liquid capital markets in emerging economies.

The Latin American region is home to over 650 million inhabitants, who are eager to advance economically. Latin America is undergoing digitalization, leveraging its resource hedge in a global inflationary environment, and benefiting from its geographic distance from major conflict zones. Although its capital markets are relatively small, investors can tailor their investment strategies to leverage the unique opportunities and mitigate specific risks.

Choice of Regional ETFs vs Country-specific ETFs

If investors seek to move beyond emerging market ETFs and adopt a more specialized approach to investing in Latin American markets, they have two alternatives:

Regional ETFs: These ETFs typically invest in a basket of assets across multiple countries within the Latin American region. The goal is to offer investors exposure to the wider Latin American market, encompassing countries such as Brazil, Mexico, Argentina, Chile, Colombia, Peru, and more. This enables investors to diversify their portfolios across the entire region rather than any single country.

Country-specific ETFs: These ETFs focus exclusively on assets from a single country. For example, some ETFs specifically track the performance of stocks listed on Brazilian exchanges (Brazil ETFs), Mexican exchanges (Mexico ETFs), or any other country in the region. These ETFs offer investors targeted exposure to a specific country’s economic performance and market movements, often preferred by investors with a high conviction of that country’s market or economy.

Important Considerations for Selecting an ETF

When choosing ETFs for your investment portfolio, it’s essential to consider several crucial factors to ensure they match your financial objectives and risk tolerance. Here are important aspects to assess when selecting ETFs:

Expense Ratio: The expense ratio represents the annual fee charged by the ETF issuer for managing the fund. Opting for ETFs with low expense ratios is essential, as higher fees can erode your investment returns over time. Comparing expense ratios across similar ETFs can help you identify cost-efficient options that maximize your investment potential.

Tracking Error: Tracking error measures how closely an ETF’s performance mirrors its underlying index. A low tracking error indicates that the ETF effectively tracks its benchmark, minimizing discrepancies between the fund’s returns and the index it aims to replicate. Assess ETFs by analyzing historical tracking error rates to determine their effectiveness in delivering steady returns relative to the index.

Liquidity: Liquidity refers to the ease of buying or selling shares of an ETF without significantly impacting its market price. High liquidity is crucial for efficient trading and ensures the ability to enter or exit your position promptly at fair market prices. ETFs with higher trading volumes typically exhibit greater liquidity, reducing the risk of encountering wide bid-ask spreads.

Investment Objectives: Understanding your investment objectives is paramount when selecting ETFs. Consider whether you seek exposure to specific asset classes, sectors, regions, or investment styles. Additionally, assess your risk tolerance and investment time horizon to determine the appropriate ETFs for your portfolio. Selecting ETFs that match your investment goals is crucial for constructing a robust portfolio, whether it’s for capital growth, income generation, or risk diversification.

By carefully evaluating expense ratios, tracking error, liquidity, and alignment with your investment objectives, you can make informed decisions when selecting ETFs to complement your investment strategy and contribute to your long-term financial success.

Understanding Potential Risks of Investing in LatAm with ETFs

Investing in Latin American markets via ETFs can offer attractive opportunities, but it’s essential to be aware of the potential risks involved. Understanding these risks is crucial for making informed investment decisions.

Currency Risk: Latin American countries often experience currency volatility due to economic instability, inflation rates, and global economic trends. Investing in ETFs denominated in local currencies exposes investors to currency risk. Fluctuations in exchange rates can impact the value of investments, affecting returns for foreign investors.

Political Instability: Political instability is another significant risk in Latin American markets. Changes in government policies, political unrest, and geopolitical tensions can disrupt economic stability and investor confidence. Such events can lead to market volatility and affect the performance of ETFs investing in the region.

Market Volatility: Latin America is the region that experiences the most volatility in the world, 1.5 times the global average. Economic factors, commodity prices, and global market sentiment can trigger significant fluctuations in stock prices and market indices. Consequently, a buy-and-hold strategy is less viable here compared to developed markets.

Regulatory Risks: Regulatory risks in Latin American markets arise from changes in government regulations, tax policies, and legal frameworks. Regulatory reforms or unexpected regulatory actions can impact industries and companies within the region, affecting the performance of ETFs invested in those sectors. Investors should stay informed about regulatory developments and their potential implications for ETF investments.

Navigating these risks requires thoroughly understanding the local market dynamics and macroeconomic factors. Diversification across asset classes and regions can help mitigate specific risks associated with investing in Latin American markets via ETFs. Additionally, investors should carefully assess their risk tolerance and investment objectives before allocating capital to these markets.

Investing via Regional ETFs

Regional ETFs offer investors targeted exposure to the diverse economies of Latin America. These funds usually consist of a mix of stocks from Latin American companies, offering a simple method to diversify across different industries. Access to Latin American equity markets is facilitated through a single investment vehicle.

A regional ETF concentrated on Latin America typically exhibits a higher expense ratio than a global ETF. This is often due to poorer liquidity, lower trading volume, and increased tracking error inherent in the Latin American markets, even when the ETFs track large-cap companies within the region.

These funds allow investors to seize the region’s growth potential while diversifying risk across countries and sectors. Diversifying across different countries in the region helps mitigate the risk of currency volatility and political instability.

Nonetheless, Latin America ETFs are not an all-in-one solution yet, as they do not perfectly reflect the present economic reality. ETFs tracking the region are highly skewed to traditional sectors, such as financials, materials, consumer staples, and energy. Despite experiencing a technological revolution, IT firms are underrepresented in Latin America ETFs.

Want to know more about the inefficiencies concerning Latin America ETFs? Click HERE.

A Comparative Overview of Region-Specific ETFs

| Name | ISIN | Total Expense Ratio | Dividend Treatment |

| Amundi MSCI EM Latin America | LU1681045024 | 0,20% | Accumulating |

| HSBC MSCI EM Latin America | IE00B4TS3815 | 0,60% | Distributing |

| iShares MSCI EM Latin America | IE00B27YCK28 | 0,20% | Distributing |

| iShares Latin America 40 ETF | US4642873909 | 0,48% | Accumulating |

| Franklin FTSE Latin America ETF | US35473P5614 | 0,19% | Accumulating |

Investing via Country-specific ETFs

Opting for country-specific ETFs to invest in Latin America provides a more focused strategy, enabling investors to concentrate on individual economies within the region. These ETFs mirror the stock performance of companies headquartered in specific Latin American countries like Brazil, Mexico, or Argentina, offering insight into each nation’s distinct economic factors and industry trends.

In general, country-specific ETFs have higher expense ratios than regional ETFs. Challenges related to liquidity, trading volume, and tracking error are even more pronounced in country-specific ETFs compared to those investing in the broader Latin America index.

Investing in country ETFs enables an investor to tailor the exposure to specific countries based on factors, such as economic growth prospects, political stability, and sector performance, potentially enhancing portfolio diversification and risk management. Furthermore, investors can capitalize on the strengths and opportunities in a country while mitigating risks associated with broader regional trends or challenges.

On the other hand, opting for country-specific ETFs exposes investors to greater risks due to the strategy’s reduced diversification. This approach is often viewed as a more high-conviction method of investing in Latin America.

A Comparative Overview of Country-Specific ETFs

| Name | ISIN | Total Expense Ratio | Dividend Treatment |

| iShares MSCI Brazil ETF | IE00B0M63516 | 0,59% | Accumulating |

| iShares MSCI Mexico ETF | IE00B0M63516 | 0,50% | Accumulating |

| iShares MSCI Chile ETF | IE00B5NLL897 | 0,59% | Accumulating |

| iShares MSCI Peru ETF | US4642898427 | 0,59% | Accumulating |

| Global X MSCI Argentina ETF | US37950E2596 | 0,59% | Distributing |

| Global X MSCI Colombia ETF | US37954Y3273 | 0,63% | Distributing |

| VanEck Vectors Brazil Small-Cap ETF | US92189F8251 | 0,66% | Distributing |

Exposure to Latin American Bond not Available

A specialized ETF focused exclusively on Latin American bonds currently does not exist. Some countries, such as Brazil and Mexico, have relatively large bond markets due to their size, economic activity, and access to international capital markets.

Investors keen on the region’s fixed-income securities can explore broader emerging market bond ETFs to gain exposure to Latin American markets. These funds provide diversified portfolios that may include Latin American debt securities alongside bonds from other emerging market economies.